Smartphones and Smart market shares

During nearly two decades working in the wireless industry, I have witnessed almost everything. From old pagers to ultra-modern tablets today; analog telephony, the GSM subscribers race, smartphones advent and early app ecosystems and now the early mobile platforms disruption.

I have seen literally hundreds of products launches and services alike, and, I have learnt an important lesson; there is only one reality but many, many ways of looking at it.

Specially now, with a particularly fragmented smartphone industry, if we want to understand the positioning of manufacturers and platform players (not to be confused), it is important to understand data figures and the sources behind.

A recent and controversial example of that, the unavoidable comparison between ComScore and GfK figures on smartphones & platforms, released after this summer period and showing strong divergence for a, supposedly, same reality.

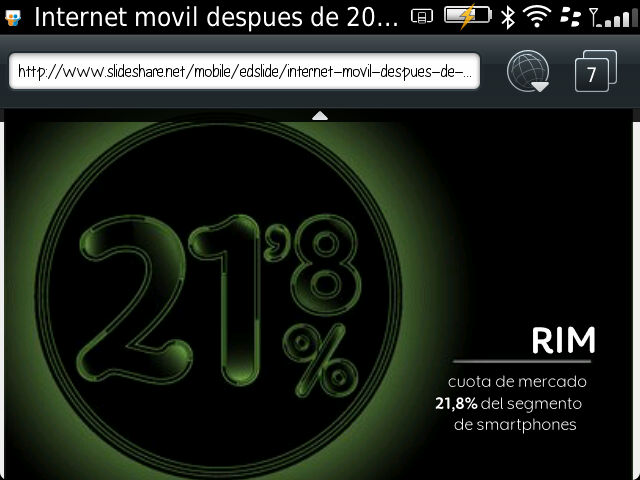

Let's start with GfK. According to GfK's July retail panel, RIM, acclaimed manufacturer of BlackBerries, grabbed a 21,8% record share of smartphone sales in Spain. GfK figures built up from direct screening of point of sale operations (invoices), meaning, pure sales to the street.

Bearing in mind GfK does not take into account corporate sales, historical RIM's sanctuary, and adding those up we can conclude one every four smartphones sold in Spain is a BlackBerry.

In contrast, ComScore data from their Mobilens report, based on, quoting literally "online survey of a national representative sample of mobile users above 13 years of age", gives opposed smartphone/platform shares to GfK.

Obviously, ComScore analysis is intrinsically different, as it refers to installed base as opposed to sell out, using a complete different methodology, based on user web interaction, by definition subject to further subjectivity compared to the indisputable invoices from point of sales.

Beyond retail sales, and their inherent seasonality cycles, campaign driven, there is even a more unquestionable reality.

Last 25th of July, Comscore released estimations on BlackBerry subscribers in UK, highlighting as many as 3,6M subscribers in that country. However, reality is there are more than 7 Million active users served through RIM's own infrastructure, managing traffic to their BlackBerries on a daily basis. The same infrastructure handling more than 15 Petabytes of data per month globally, and providing BlackBerry service to more than 2 Million happy users in Spain. Spain, a country supposedly having one fifth of those subscribers according to Comscore.

As I grow older, I tend to think there is not an absolute truth but I do believe in technology, network infrastructure and the reality we built upon that foundation.

@efernandez